For wealth managers, alternative investments have emerged as a crucial opportunity to cater directly to high-net-worth individuals. Recent data reveals that alternative investments typically constitute around 50% of high-net-worth investors’ portfolios, underscoring the growing demand for these assets among affluent clientele.

However, a significant disconnect in alternative investments persists between financial advisors and asset managers.

The Alts Opportunity for Financial Advisors

For financial advisors catering to affluent clients, alternative investments are a necessity. These assets offer unique avenues for portfolio diversification and risk management, allowing advisors to tailor investment strategies that align closely with the sophisticated needs of their clientele.

Yet, despite the eagerness to delve deeper into alternatives, advisors often encounter barriers that hinder their ability to fully leverage these opportunities for their clients.

The Alts Opportunity for Asset Managers

Simultaneously, asset managers are in a prime position to capitalize on the burgeoning interest in alternative investments.

By offering innovative private investment offerings, asset managers can not only attract high-net-worth investors individually, also forge strategic partnerships with financial advisors of top-tier investors who are seeking to broaden their service offerings.

Common Alts Barriers Restricting the Partnership

But even for both parties who recognize the opportunity, they’re faced with barriers that prevent them from moving forward. Common barriers include:

1. Lack of Transparency and Reporting Capabilities: Traditional investment vehicles often offer robust reporting mechanisms, providing investors and advisors with clear insights into portfolio performance. However, the opacity surrounding alternative investments presents a significant challenge. Without standardized reporting frameworks, financial advisors may struggle to accurately assess the performance and risk profile of alternative assets, leading to a reluctance to incorporate them into client portfolios.

2. Inability to Integrate with Advisors’ Existing Systems: Seamless integration with advisors’ existing systems is essential for the effective management of alternative investments. Yet, many asset managers lack the technological infrastructure necessary to facilitate such integration. As a result, financial advisors are forced to navigate disparate platforms and manual data entry processes, leading to inefficiencies and a fragmented view of client portfolios.

3. Inability for Advisors to Bill on Alternative Investments: Billing on alternative investments presents a unique challenge for financial advisors. Unlike traditional assets, which are typically subject to standard fee structures, alternative investments often require customized billing arrangements based on performance or other factors. Without the ability to accurately track and bill on alternative investments, financial advisors may face difficulties in monetizing their services and justifying their value proposition to clients.

These barriers, among others, underscore the need for innovative solutions that address the complexities inherent in alternative investments.

Solving the Alts Gap With Technology

Today, new technology is eliminating these challenges making it possible for advisors and asset managers to unlock new opportunities for collaboration and growth, ultimately empowering their clients to navigate the evolving landscape of wealth management with confidence and clarity.

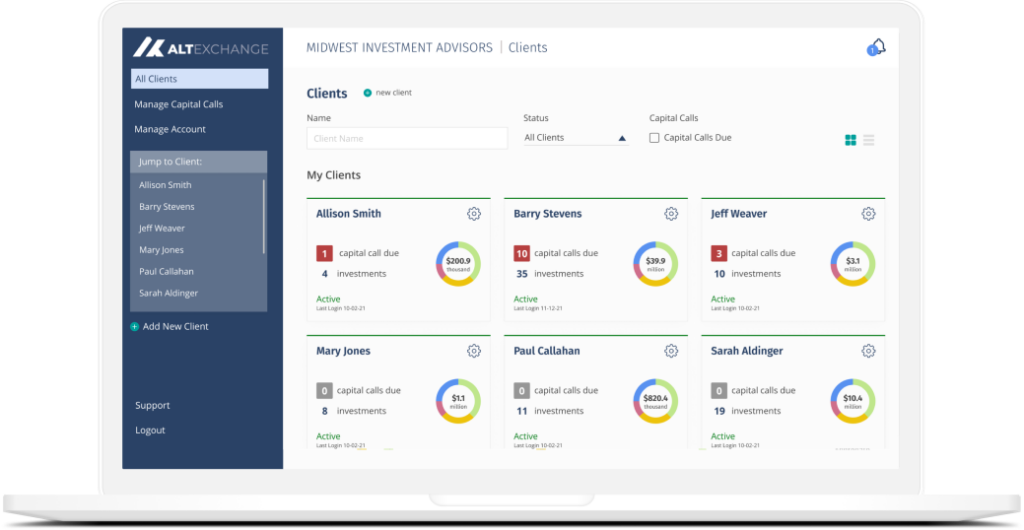

AltExchange, a technology-based alternative investment management solution for advisors and asset managers, is leading the force in bridging the gap. From access to aggregation, reporting, and integrations, AltExchange offers a way to streamline the entire alternative investment process for advisors and asset managers.

For financial advisors, AltExchange’s AdvisorVue platform makes managing clients’ alternative investments effortless. By aggregating clients’ portfolios, standardizing data, and automating reporting processes, AdvisorVue empowers advisors to offer unparalleled transparency and insights into alternative investments. Moreover, its seamless integration with existing systems ensures a frictionless experience for advisors and their clients.

Similarly, AltExchange’s Digital Custodian Platform (DCP) provides asset managers with a powerful tool to enhance their offerings and expand their client base. By standardizing reporting data, automating investor reporting, and facilitating seamless integration with advisors’ systems, DCP enables asset managers to unlock new avenues for growth and collaboration.

If you’re an advisor or asset manager curious about capitalizing on the biggest untapped opportunity yet, get more information or book a time.