Financial advisors are under increasing pressure to stay competitive, win new business, and still maintain the best client experience for their current clients. Outsourcing is becoming an attractive option for financial advisors who want to save time, money and resources while still providing their clients with the best financial advice and client experience possible. By outsourcing areas of preparing tax documents, managing capital calls, and reporting on various funds, financial advisors can free up more time to focus on winning new business and better serving existing clients.

Here are key areas financial advisors can outsource to help save time, money and improve client experience.

Back Office Areas to Outsource

1. Collecting Tax Documents

For financial advisors, outsourcing back office work can be a great way to save time and money while still providing the best financial advice and client experience. Common time-consuming back office tasks include collecting and preparing tax documents, managing capital calls, and reporting on various funds.

According to research from various financial advisory firms, financial advisors and tax advisors can spend up to four hours a day preparing tax documents for their clients. This includes things like reviewing financial statements and financial statements of the client’s business, completing any necessary forms, and entering financial data into applicable software systems.

2. Managing Capital Calls

Managing capital calls can be a time-consuming and complex task for financial advisors.

A capital call is issued when a fund manager asks investors to contribute a certain amount of capital to the fund. For many funds, the capital call notice will be about 10 days in advance. Missed capital calls, however, can result in major penalties, may impact the health of the fund, and can result in legal action. Therefore, it’s imperative for investors to meet all capital calls in the timeframe they’re required to.

For advisors dealing with clients who invest in multiple private funds, the amount of capital calls can be overwhelming. So much so, that many advisors refuse to take them on. But helping your clients with capital calls can provide major value, and help you win more high-net-worth business.

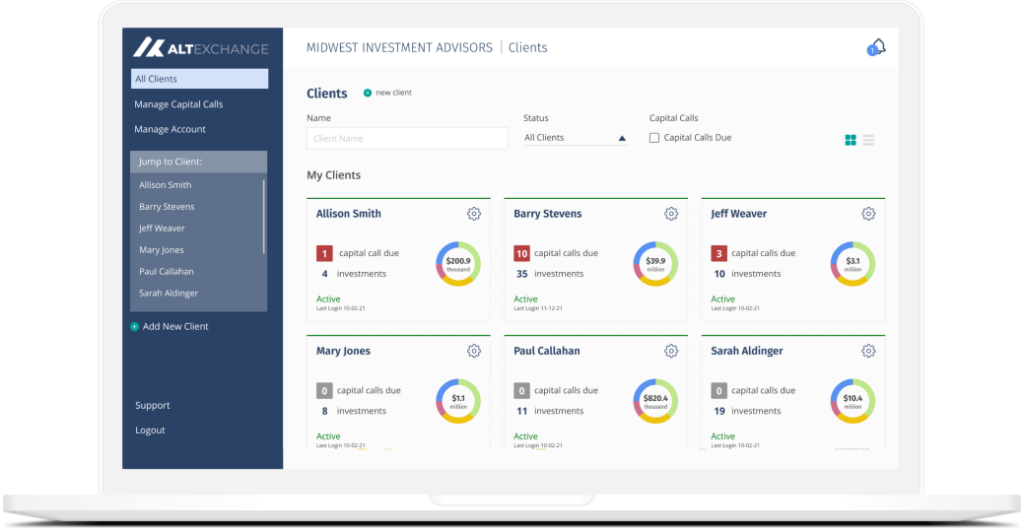

Technology can make the capital call process completely seamless. AltExchange automatically syncs daily with all investments held on the platform, and will flag when a capital call is issued. From there, clients receive automatic reminders and notices regarding their capital calls. This allows advisors to help clients manage capital calls without doing any of the manual work themselves.

Manual Reporting Processes

While some advisors are still not reporting on their clients’ private investments (real estate, private equity, startups, etc.), some are. And most of those who are doing so are reporting entirely manually via messy, outdated spreadsheets. This process is extremely time-consuming and completely unsustainable for a client base of complex portfolios.

Luckily, outsourcing reporting, even on alternatives, is now possible due to new technology. Our platforms allow advisors to automate alternative investment reporting and management. We aggregate all investments, authenticate the investments, collect any incoming documents or data regarding the investment, and provide historical and real-time reporting on all investments tracked on the platform. This allows advisors to easily offer management of alternatives for clients who may be interested in alts or who already are invested in alts.

Overall, if you’re a financial advisor looking to better serve your clients, enhance your relationships, and win new business, it’s essential to outsource your back office tasks. By doing so, you’ll have more time and resources to allocate to the areas that matter most.

If you’re an advisor looking to outsource your tax document collection, capital call management, and private investment reporting, please get in touch at or schedule a quick demo today.