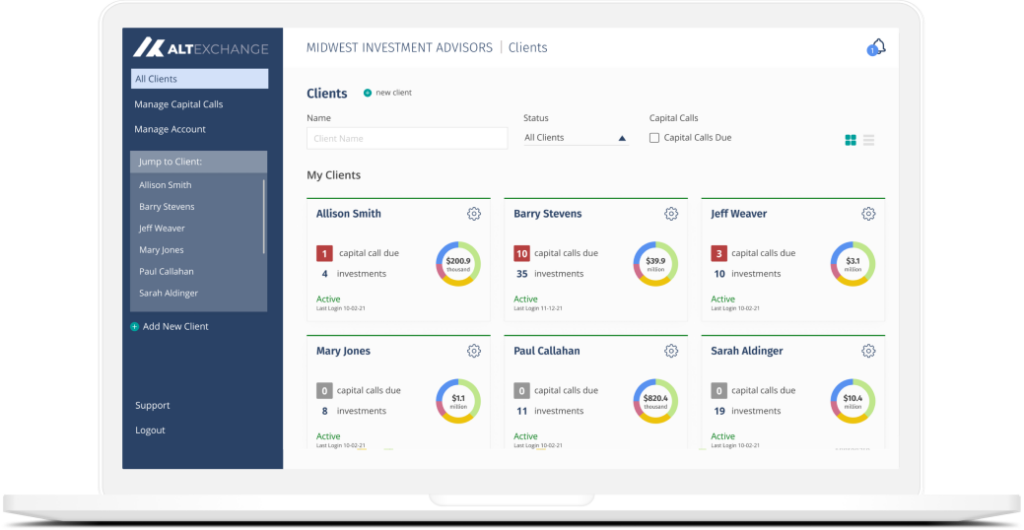

AdvisorVue transforms workflow by digitizing illiquid investments, eliminating manual data entry, and aggregating clients’ alts on one platform.

(NEW YORK CITY, Aug. 31) – Today, AltExchange launches AdvisorVue: A breakthrough alternative investment platform built for the modern-day financial advisor.

AdvisorVue helps financial advisors provide family office-like services through:

- Portfolio Management: Aggregation and consolidation of clients’ private investments including private equity, venture and hedge funds, real estate, startups and more.

- Performance Reporting: Structured, standardized data to manage, track, and report on private investments.

- [Tax] Accounting: Automated collection and distribution of tax documents, easily accessible on the platform.

- Onboarding: Both advisors and their clients experience a fully-managed onboarding process.

- Interoperable Integrations: Built to be interoperable and integrate with the leading portfolio management systems Advisors currently use (e.g. Black Diamond, Addepar, Tamarac).

Zak Boca, CEO of AltExchange said:

“Alternative investments have rapidly made their way into investors’ portfolios over recent years. Yet financial advisors’ existing solutions have not kept up with client demand. After months of asking financial advisors what they need most, the verdict was a family office-like experience for clients. We are thrilled to offer advisors a highly-automated, scalable solution for alternative investments, to give their business an edge and provide the best service possible for clients.”

For a limited time, advisors can track up to $25M in assets for free with AdvisorVue.

To start giving your business an edge, please schedule a demo or contact us at hello@altexchange.com.