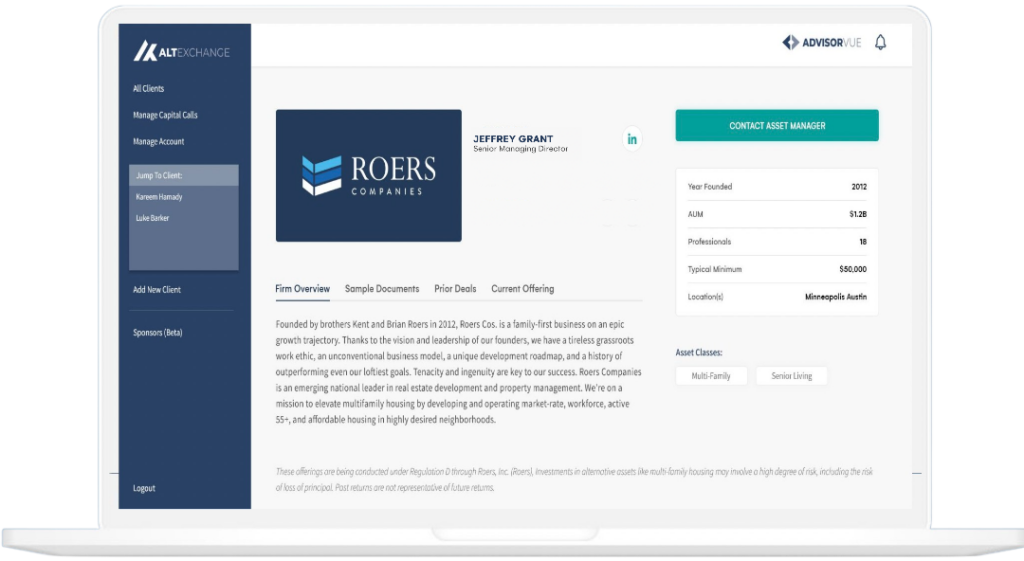

AltExchange’s Digital Custodian Platform allows asset managers to provide modern reporting for alternative investments, without changing existing systems.

[Originally published to EIN Newswire.]

NEW YORK CITY, March 28, 2023 – AltExchange, a fintech company digitizing alternative investments, launched a Digital Custodian Platform for asset managers to modernize and digitize alternative investment reporting. AltExchange’s new Digital Custodian Platform allows asset managers of alternative investments to easily reach RIAs and reduce friction for their LPs.

Through AltExchange’s Digital Custodian platform, asset managers can provide advisors and clients confidence and clarity in their alternative investment offerings, through real-time, transparent performance data. AltExchange’s Digital Custodian platform also removes friction and administrative barriers for RIAs and their clients with:

- One login for all clients’ alternative investments

- Extracted and structured data from PDFs and online portals

- Comprehensive performance reporting

- Automated tax document collection and distribution (K-1s, 1099s)

- Direct reporting to TAMPs

- Open architecture (Keep existing systems)

- Ability to bill on alts, unlocked

- Integrations with wealth management systems

- Fully-managed solution (software + service)

“AltExchange’s Digital Custodian Platform is very simple – We provide a custodian experience for both sponsors and outside managers, without the sponsor changing the way they administer funds or accept subscription documents. Our open architecture approach works with all fund administrators, and as a result, we can instantly provide sponsors with a way for RIAs to bill and report on their alts.”

Zak Boca, CEO of AltExchange

For more information on AltExchange’s Digital Custodian Platform for asset managers, please contact hello@altexchange.com. Or, please visit our website for more information.