A recent survey conducted by Edelman Financial Engines reported that 75% of respondents said that money issues are a source of stress. 52% of households who did not work with a financial professional reported feeling stressed within the past six months, compared to 39% who are working with a financial professional. Of those who work with an advisor or financial professional, 83% reported being less stressed because of the help they receive from them.

According to the numbers, if you’re an advisor, there’s a good chance you’re already helping your clients reduce stress. Regardless though, people are stressed about money issues right now, advisor or not. Here’s how you can further reduce stress for your clients.

Prepare in advance

In times of financial uncertainty, advisors are in a unique position to help their clients navigate the tumultuous waters of economic downturns like recessions. By proactively preparing their clients well in advance for possible financial hardships, financial advisors can provide invaluable assistance and reduce stress levels that could otherwise be overwhelming. With the right planning strategies and guidance from an experienced financial advisor, clients can be better prepared to weather any potential storm that may come their way.

But advisors should stay prepared too. Rather than waiting until times are tough, get a strategy in place now to ensure your investments perform well during recession, such as increasing allocations to alternative investments. In addition, utilize technology to help you manage the complexities.

Create a customized portfolio for each client

Offer customized portfolios tailored to each client’s individual needs and financial goals, especially in times of economic hardship. Customized portfolios should be based on each of your clients’ financial goals, their risk tolerance, and other factors like age, family status, and years to retirement.

One area many advisors fail to consider are their clients’ additional investments and sources of wealth outside of their actively-managed investment portfolio. This is a huge missing piece though for many clients. Gain a holistic view by incorporating your clients’ alternative assets such as direct-owned real estate, equity, and additional private investments such as private equity, hedge funds, and more.

Focus on the long term

One of the most important roles financial advisors can play in helping their clients reduce stress is to keep them focused on the long term. By providing guidance and support, financial advisors can help their clients look beyond current market conditions and create a plan for financial success over time.

In times of economic uncertainty, it’s easy for investors to become overwhelmed by short-term volatility and make decisions based on emotion rather than logic. Advisors should emphasize the importance of staying focused on long-term goals such as retirement planning or other financial objectives that will be realized over many years, not just during this momentary downturn.

Boost returns with alternative investments

Alternative investments are be a critical component of financial portfolios during recessionary periods, offering investors the opportunity to boost returns and protect their financial interests. These investments provide financial advisors with the ability to expand their clients’ financial portfolios beyond traditional stocks and bonds in order to better manage risk and increase long-term wealth.

Specifically, advisors should tap into illiquid alternative investments such as private equity, real estate, hedge funds, and more. These investments offer a way to protect against quick, panic-selling based on emotion and fear. Avoid liquid alternatives like crypto or other highly volatile investments that are correlated with the markets and allow for actions based on emotion.

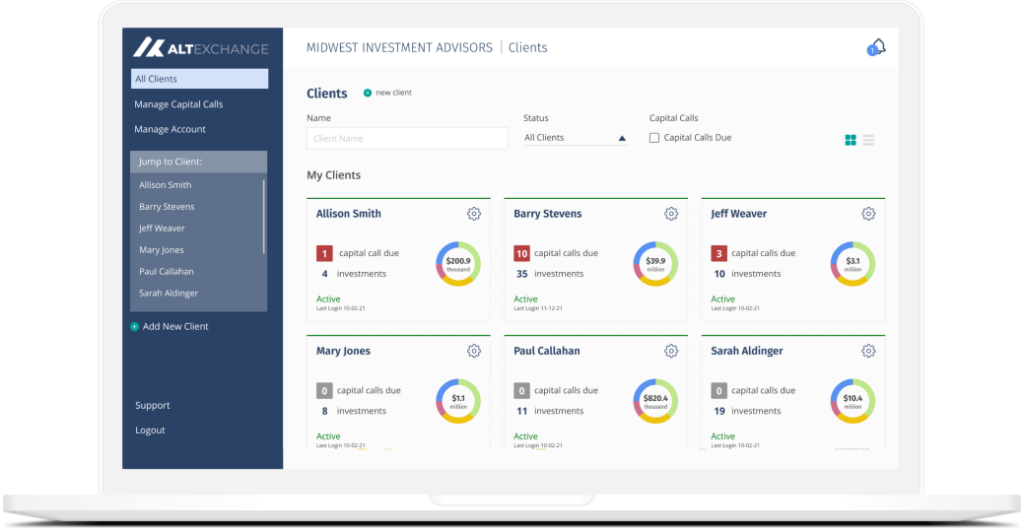

As mentioned, alternatives can come with greater complexities. In fact, most advisors who offer alternatives are still managing them entirely manually via spreadsheets. This is not sustainable for building a portfolio of alternatives among various clients.

If you’re an advisor currently offering alternative investments or interested in getting started, see how AltExchange can help you reduce the complexities and manage alternatives for your clients as easily as stocks.