Gone are the days of cookie-cutter management strategies from financial advisors. One of clients’ top priorities in today’s day and age when it comes to finding a financial advisor, is finding someone who can gain a complete understanding of their portfolio, their future financial goals, and ultimately give guidance from a holistic standpoint.

Here’s how financial advisors can manage their clients’ portfolios holistically.

How to Gain a Holistic View of Your Clients’ Portfolios

In order to gain a holistic understanding of clients’ wealth, financial advisors should have in-depth knowledge of all the assets, liabilities, income sources, investments including alternative investments, and other financial obligations that make up a client’s financial situation.

This information helps advisors provide tailored advice based on each individual’s needs and goals, and ensure that their recommendations are always in line with their client’s current financial standing and objectives.

Furthermore, keeping track of any changes in your clients’ portfolio over time helps them stay ahead of any potential risks or opportunities as they arise.

One roadblock when it comes to managing your clients’ wealth holistically, though, is the time spent tracking these changes. Many advisors have up to hundreds of clients to manage, so it can be difficult as is to provide the most tailored advice possible. Here’s how advisors can track wealth, without excess spending hours upon hours doing so.

How to quickly and easily track your clients’ wealth

Most advisors have a streamlined process in place to track traditional investments: stocks, bonds, and more. But what about your clients’ direct-owned real estate? Or their private equity investments? Or even a valuable jewelry collection they may have?

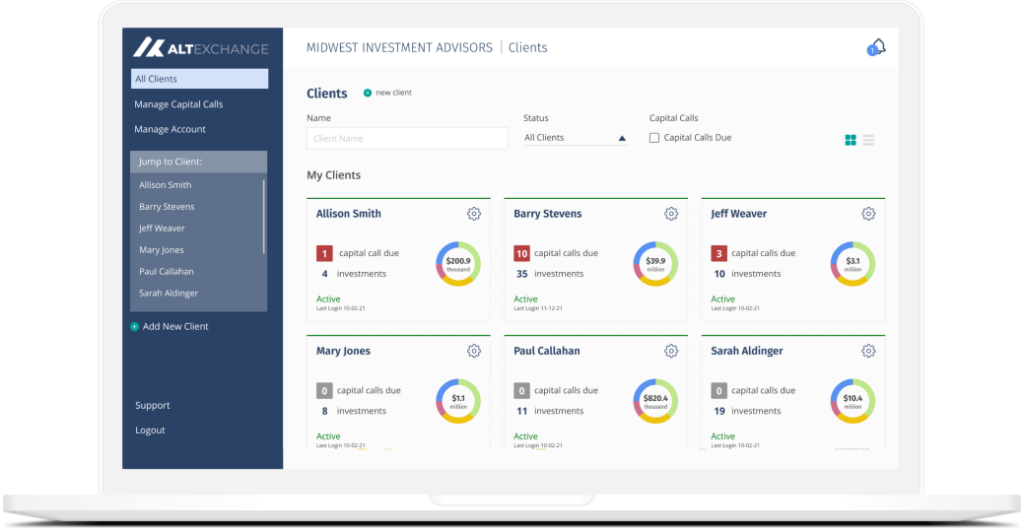

With modern-day technology, advisors can implement systems to easily manage and report on alternatives without the headaches. AltExchange allows wealth professionals to easily aggregate, report, and ultimately manage a breadth of alternative investments, in a fully-automated way, just as you would traditional investments.

Overall, investors, especially high-net-worth individuals and their families, are looking for a full understanding of their portfolios, and a financial advisor, who will help them manage them holistically. By tracking alternative investments for your clients with technology, advisors who can gain a complete understanding of their clients’ portfolio, better plan for the future financial goals, and win more clients.

If you or your firm are looking for a solution to help you achieve all of the above and more to provide the best client experience possible, please get in touch.