Financial advisors are in the business of helping people achieve financial security and build wealth. To do this, they must create a positive client experience that builds trust and ensures satisfaction. This means going beyond providing financial advice to creating an environment where clients feel valued and understood. By focusing on building strong relationships with their clients, financial advisors can ensure that their financial plans are tailored to meet individual needs while setting them up for success in reaching their financial goals. With the right approach, financial advisors can provide an extraordinary client experience that helps bring peace of mind and confidence in achieving a secure financial future.

Here are ways financial advisors can go above and beyond in their practice to create an extraordinary experience for their clients.

Connect with your clients

Staying connected with clients is a critical part of financial advising. It allows financial advisors to build strong relationships by understanding their client’s goals and financial needs, while also providing support and guidance through difficult financial decisions. Connecting with clients on an emotional level helps them feel valued and heard, which in turn builds trust between the advisor and client. This trust is essential for financial advisors as it ensures that their advice will be taken seriously and followed through on.

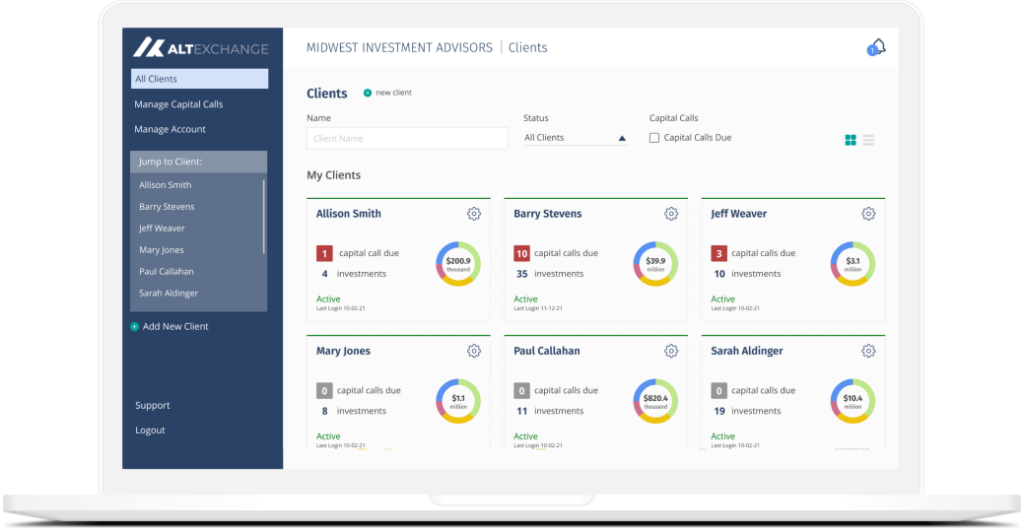

There are various ways for advisors to connect regularly with their clients, without having to schedule excess one-on-one meetings. Sharing updates via weekly emails, creating a monthly newsletter, or even sharing your voice on platforms such as LinkedIn can help you stay connected. In addition, utilizing technology platforms to send instant notifications such as capital call reminders and notices, can help you stay connected.

Gain a holistic understanding of each clients’ finances

One area in which many advisors are lacking, and what clients are highly prioritizing, is a holistic overview of their portfolio. A financial advisor should have an in-depth knowledge of all the assets, liabilities, income sources, investments including alternative investments, and other financial obligations that make up a client’s financial situation. Having this information allows advisors to provide tailored advice based on each individual’s needs and goals, and ensure that their recommendations are always in line with their client’s current financial standing and objectives. Furthermore, tracking changes in a client’s portfolio over time helps them stay ahead of any potential risks or opportunities as they arise.

Ultimately, having a comprehensive view of your clients’ net worth enables financial advisors to provide more meaningful guidance while helping them achieve success in reaching their desired financial goals.

Ditch the 60/40 portfolio

The traditional 60/40 portfolio, which consists of a mix of stocks and bonds, is no longer the best financial solution for many investors. This old-fashioned approach has become outdated as financial markets have evolved over time and new opportunities have emerged. Today’s financial advisors must consider other asset classes to diversify their client’s portfolios and help them reach their financial goals.

Alternative investments, such as private equity, hedge funds and real estate can help diversify a client’s portfolio while providing them with access to higher potential returns that are not available through stocks and bonds alone. For advisors currently offering alternatives or who are interested in offering alternatives, they can come with complexities. It’s important to have a system in place to ensure you’re able to easily manage and report on alternatives without the headaches.

If you or your firm are looking for a solution to help you achieve all of the above and more to provide the best client experience possible, please get in touch.