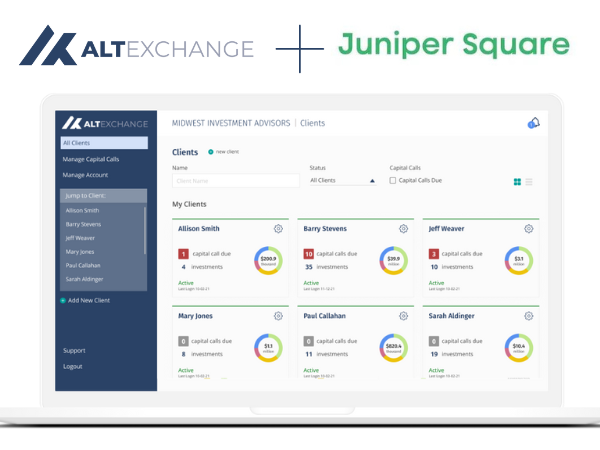

AltExchange Integrates with Juniper Square to Connect Private Investment Asset Managers Directly to Financial Advisors

AltExchange has integrated with Juniper Square to streamline the transfer of data from asset managers to financial advisors, unlocking new possibilities for offering private investment funds and providing a superior reporting experience for advisors and their clients.

This integration with Juniper Square serves as a pivotal bridge between asset managers and financial advisors. The synergy between these platforms enables asset managers to effortlessly share critical investment data with financial advisors, eliminating the barriers advisors often face that prevent them from being able to invest in private funds for their clients.

Automated Data Transfer from Private Investments to Advisors

With AltExchange, asset managers who use Juniper Square can now automate the transfer of data into financial advisors’ wealth management systems. By providing a direct feed into advisors’ systems, it allows for an effortless, fully transparent, accessible experience that mimics the simplicity of traditional investments.

By integrating directly with advisors’ systems, advisors can now seamlessly access and manage alternative investment data alongside traditional investments in one consolidated platform. The manual headaches of data transfer are a thing of the past, allowing for a more streamlined and efficient workflow.

Empowering Asset Managers to Expand Investment Offerings to Advisors

For asset managers, the AltExchange and Juniper Square integration opens up new avenues for offering private fund investments to financial advisors. AltExchange’s role as a conduit ensures that RIAs receive the necessary exposure to diverse investment types offered by private fund managers.

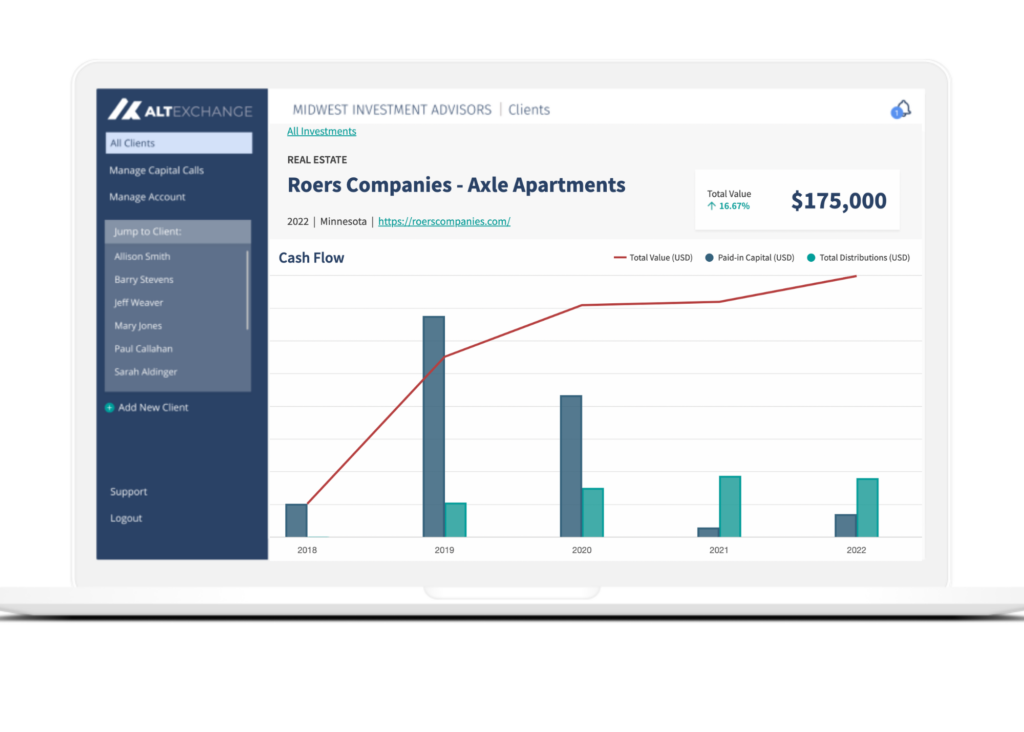

Roers Companies, a Minnesota-based real estate development company, serves as a prime example of how this integration empowers asset managers. Jeffrey Grant, Senior Managing Director at Roers Companies, emphasizes the impact of AltExchange:

“Previously, we were all data-oriented in-house. It was just getting that outside of the house to the RIA, and that’s where AltExchange is the conduit.

Partnering with AltExchange has given us the opportunity thrive in the RIA market and beyond. We’re able to offer unique, private real estate investment opportunities for RIAs and their clients, without the complexities. Not only has AltExchange positioned Roers as a partner to RIAs, but RIAs can expand their client base with the ability to offer sought-after private investments. It is a win-win solution for everyone.”

Providing A Next-Level Reporting and Management Experience for Advisors

Not only can asset managers expand their offerings to advisors, they can take it even further with next-level reporting and management.

The demand for unique alternative investment opportunities is increasing, especially among wealthy investors whose portfolios are allocated 50% to alts, on average. With AltExchange, asset managers can provide advisors with the comprehensive insights and opportunities that allows them to provide a truly unique, personalized wealth management experience for their top clients.

Start Streamlining Your Private Investment Offerings

By simplifying data transfer, enhancing reporting capabilities, and facilitating seamless collaboration, AltExchange’s integration with Juniper Square marks a significant leap forward in alternative investment management.

Asset managers now have a powerful tool at their disposal to market, offer, and report on their funds effectively, while financial advisors can provide their clients with a next-level client experience. AltExchange is proud to continue paving the way for a more connected, efficient, and modern future for alternative investment management.

To learn how AltExchange can help you streamline your fund offerings and reporting to RIAs, please get in touch or book a call.