Top Takeaways from Orion Ascent 2024

The AltExchange team had the pleasure of attending the 2024 Orion Ascent Conference in San Diego, California last week. The annual conference brings together the industry’s top financial advisors, innovators, and leaders – and we were thrilled to take part.

This year’s conference focused on how to be unstoppable in wealth management. Among many key topics, we’re breaking it down into a few simple highlights. Here are the top three takeaways from Orion Ascent 2024 on how to be an unstoppable advisor.

1. Choose and Use the Right Technology

Technology is key to powering continued growth.

Orion CEO Natalie Wolfsen kicked off the opening keynote session with new Wealthtech Survey results, showing that only one in ten advisors say their firm has all the technology solutions they need, and that more than half (52%) of advisors plan to invest more in client-facing technology this year. In addition, overall technology expenditure is expected to rise again this year, highlighting a continued commitment to leveraging technology as a driver of future growth.

Now more than ever, every advisor needs to stay updated with the latest technological advancements as it’s no longer a bonus, it’s a necessity and the industry standard. With clients expecting superior service, embracing new technology becomes indispensable for improving practice efficiency, elevating client satisfaction, and achieving overall success.

We are all well familiar with many of the benefits of technology, but what are the pain points? According to the survey, advisors cite disconnected solutions as their primary tech pain point, reporting only half of their technology as being integrated. When choosing technology investments for your firm, make sure to consider its integration capabilities to ensure your tech leaves you with more time and resources to serve your clients, rather than more headaches.

2. Win High-Net-Worth Clients With Personalization

“Investors are demanding more of their advisors and advisors are poised to deliver. In the next three years, two-thirds of advisors (64%) say they will deliver a more personalized, customized client experience,” said Natalie Wolfsen, CEO of Orion.

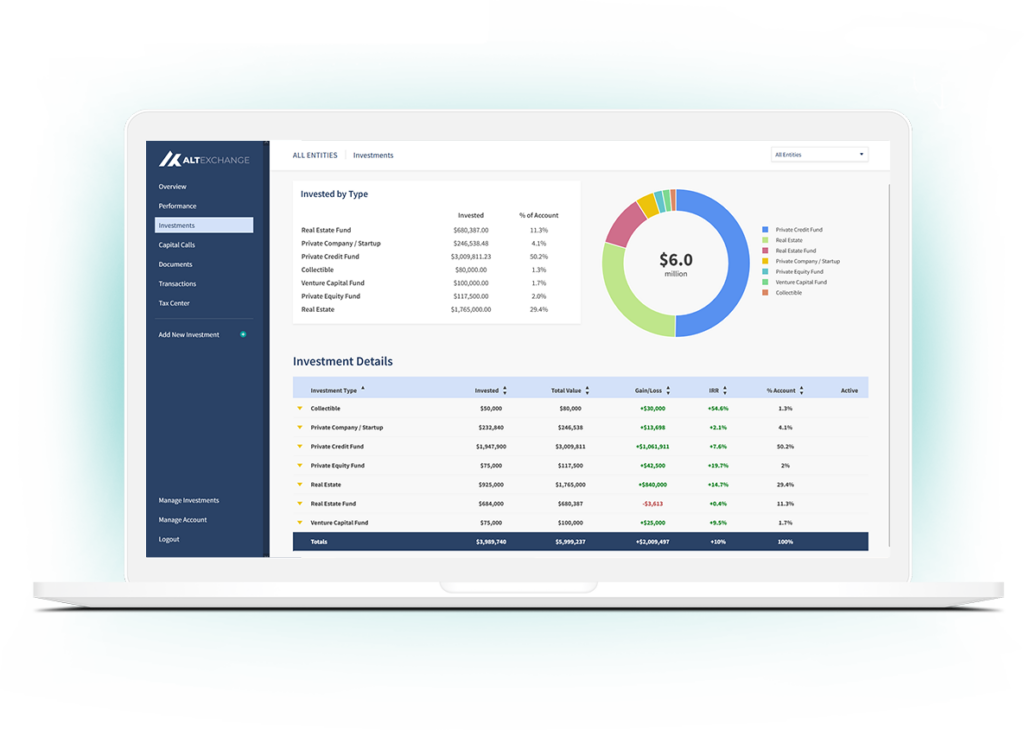

When it comes to offering tailored, personalized wealth management services, incorporating alternative investments is a must-have for high-net-worth investors. On average, alternative investments make up nearly half of high-net-worth investors’ portfolios. Popular alternative investments include real estate, private equity, hedge funds, collectibles, startup investments, and more.

While incorporating alternative investments used to be a manual, daunting task for most advisors – technology is making it manageable and in some cases, as simple as managing traditional investments.

Here are key questions to ask when choosing technology to help you serve wealthy clients:

- Does it integrate with my existing systems?

- Does it promote collaborative client engagement?

- Does it provide comprehensive reporting and analysis?

- Does it offer a holistic view of my clients’ portfolios?

- Does it incorporate alternative investments?

- Does it provide tailored portfolio construction and optimization strategies?

3. Outsource to Win Back Time

One of the best things you can do as an advisor is spend more time with your clients. But that’s easier said than done, especially while keeping up with growing client demands.

According to Orion’s survey, here’s what advisors report they’re currently fully or partially outsourcing:

- Compliance and regulatory reporting: 46%

- Portfolio accounting: 46%

- Investment management: 38%

- Trade execution: 36%

- Client reporting and communication: 34%

Fortunately, technology has made it simpler than ever to outsource various tasks and win back precious hours you could be spending serving your clients. For example, advisors who use AltExchange report a 70% reduction in time spent collecting tax documents, as it’s now automatically done for them.

Final Takeaways…

While there are plenty more important topics that came out of this year’s conference, the overarching theme is that technology is helping advisors become unstoppable in 2024. With the right resources and strategies on your side, you’ll be on track to win back time, win new clients, and better serve your existing ones.

If you’re interested in how AltExchange can help you provide a personalized experience with automated alternative investment aggregation, management, and reporting, please get in touch.

We hope you enjoyed this round-up of Orion Ascent 2024, and look forward to meeting you next year!