If you’re looking for a high-yield investment with stability, private debt may be a good option for you. However, it’s important to do your research before investing in private debt.

Here are five key factors to consider before making an investment in private debt.

1) The debt’s credit quality

When investing in private debt, it’s important to consider the credit quality of the debt. This means looking at the credit rating of the company or individual that is borrowing money. A high credit rating indicates that the borrower is likely to repay their debt on time and in full. Conversely, a low credit rating suggests that the borrower is more likely to default on their loan.

If you’re investing in private debt, you want to make sure that the debt you’re investing in has a high credit quality. This will help ensure that your investment is stable and reliable. Additionally, a high credit quality can help you earn a higher return on your investment.

2) How the private debt is structured

There are a variety of ways private debt can be structured. The most common way private debt is structured is through a private loan. This is when a company or individual borrows money from a private lender. The private lender then becomes the creditor of the company or individual.

Another way private debt can be structured is through a private credit facility. This is when a group of lenders come together to provide a company or individual with credit. This type of financing is typically used by larger companies that need more capital than a single private lender can provide.

Lastly, private debt can also be structured as a private placement. This is when a company or individual sells securities to investors in order to raise money. These securities are often high-yield, which means they offer investors a higher return than traditional investments.

3) The sponsor or management company

When investing in private debt, it’s important to consider the sponsor or management company. The sponsor or management company is the company or individual that is responsible for the management of the private debt investment. This means they are in charge of finding new borrowers, negotiating loans, and monitoring the investments.

The sponsor or management company can play an important role in the success of your private debt investment. They can help you find high-quality borrowers and make sure that your investment is properly managed. Make sure to do your research on the sponsor or management company before investing in private debt.

4) The terms of the loan

When investing in private debt, it’s important to be aware of the terms of the loan. This includes things like the interest rate, maturity date, and repayment schedule. By understanding the terms of the loan, you can ensure that you are making a wise investment decision.

It’s also important to be aware of any fees associated with the private debt investment. These can include origination fees, late payment fees, and prepayment penalties. By understanding all of the terms of the loan, you can avoid any surprises down the road.

5) The liquidity of the investment

The liquidity of an investment refers to how quickly it can be converted into cash. When investing in private debt, it’s important to consider how liquid the investment is. This will help you determine if you’re able to sell your investment if needed.

Generally, private debt investments are less liquid than traditional investments like stocks and bonds. However, there are some private debt investments that are more liquid than others. Make sure to do your research on the liquidity of each private debt investment before making a decision.

Managing private debt investments

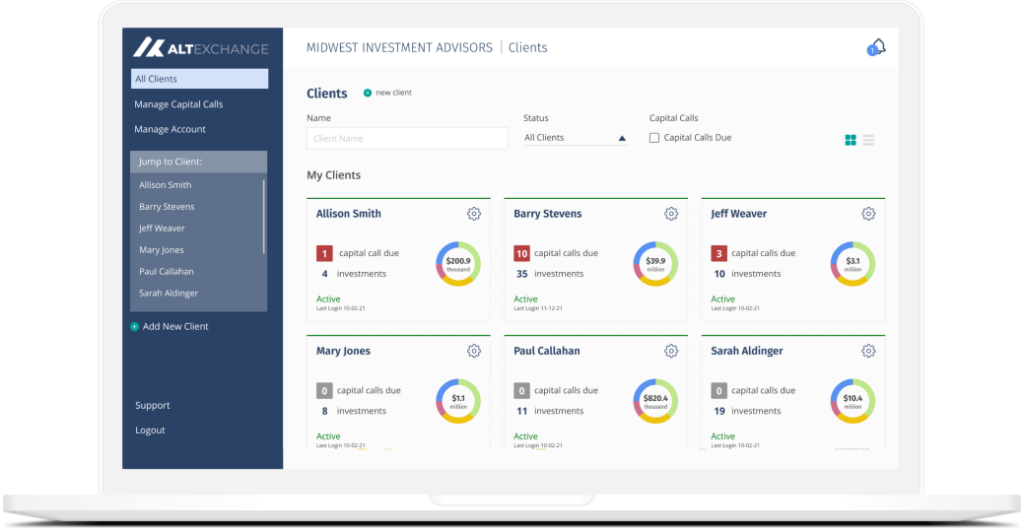

If you or your clients are investors of private debt, you do have an alternative to managing your investments via a spreadsheet.

AltExchange eliminates the pain points of managing complex alternative investments including fragmentation, unstructured data, scattered documents, limited performance visibility, and more. If you’re an advisor, investor, or asset manager looking for a full-solution management and reporting solution for alternative investments, please get in touch.