AltExchange’s technology-powered Tax Center collects and stores tax documents for alternative investments, saving investors, advisors, and CPAs hours on taxes.

NEW YORK CITY, October 12, 2022 — Today, AltExchange launches Tax Center: A technology-powered solution built for investors, advisors, and CPAs that collects and stores tax documents for all alternative investments.

- AltExchange’s Tax Center:

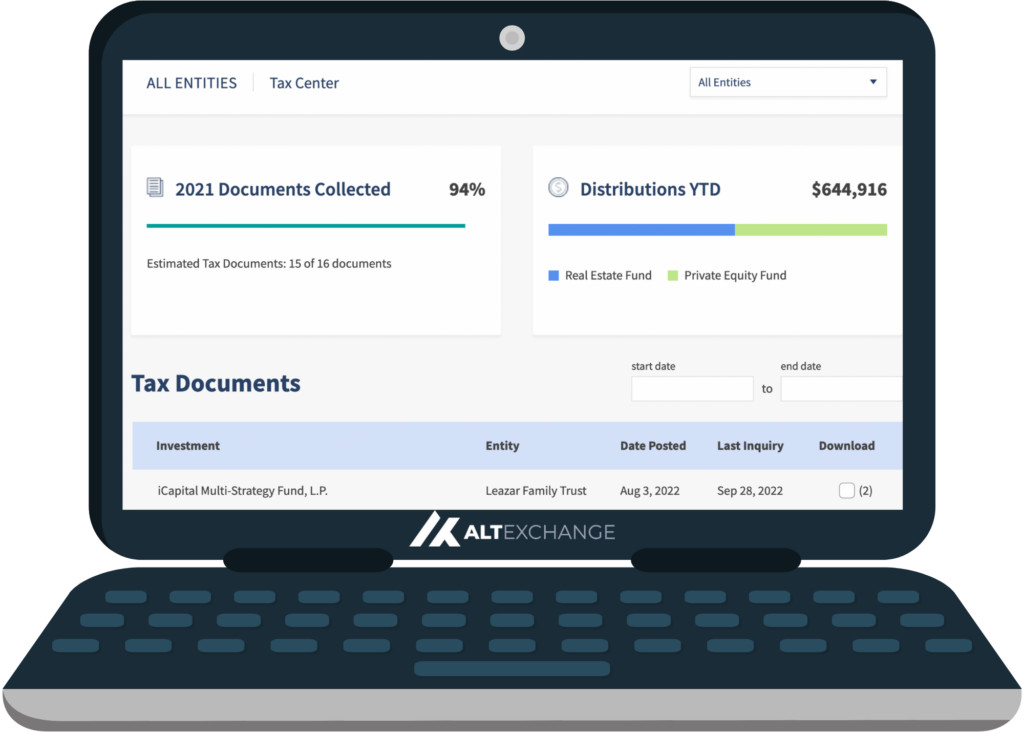

- Automatically collects, organizes, and distributes tax documents (e.g. K-1s, 1099s) for all alternative investments, easily accessible and downloadable on the platform.

- Includes investments in private funds, online funding platforms (e.g. CrowdStreet, Wefunder), startups, direct-owned real estate, and more.

- Tracks prior year and current year distributions by asset type, simplifying quarterly tax estimates.

- Integrates with leading advisor portfolio management systems (e.g. Black Diamond, Addepar, Tamarac).

Zak Boca, CEO of AltExchange said:

“One of the biggest pain points we hear from advisors, tax consultants and investors of alternatives is difficulty in collecting and managing tax documents. Our goal as a company is to simplify the management of alternatives in every aspect, providing a brokerage-like experience for alts. We’re excited to introduce yet another automated solution that further reduces friction for all participants in the alts space.”

Tax Center is now available to wealth advisors and direct investors.

To streamline the tax process for you or your firm’s clients, please schedule a demo or reach out at hello@altexchange.com.