Fundrise is one of the more recent success stories of online funding portals that have benefited from alternative investments going mainstream.

Fundrise overview

As an investor, I especially like real estate projects like the ones Fundrise acquires because they tend to do well in most economic environments. For example, if we suddenly had less than adequate housing as we did in 2008, unlike office spaces, lease terms are short. In the case of a downturn, investors may only have a year or two of lower rents and ultimately lower internal rate of returns (IRRs).

As Fundrise mentions on their website, real estate investments also have the following benefits, over a traditional 60/40 investment portfolio allocation: income or investment yield, increased stability over public equities, and improved risk-adjusted return.

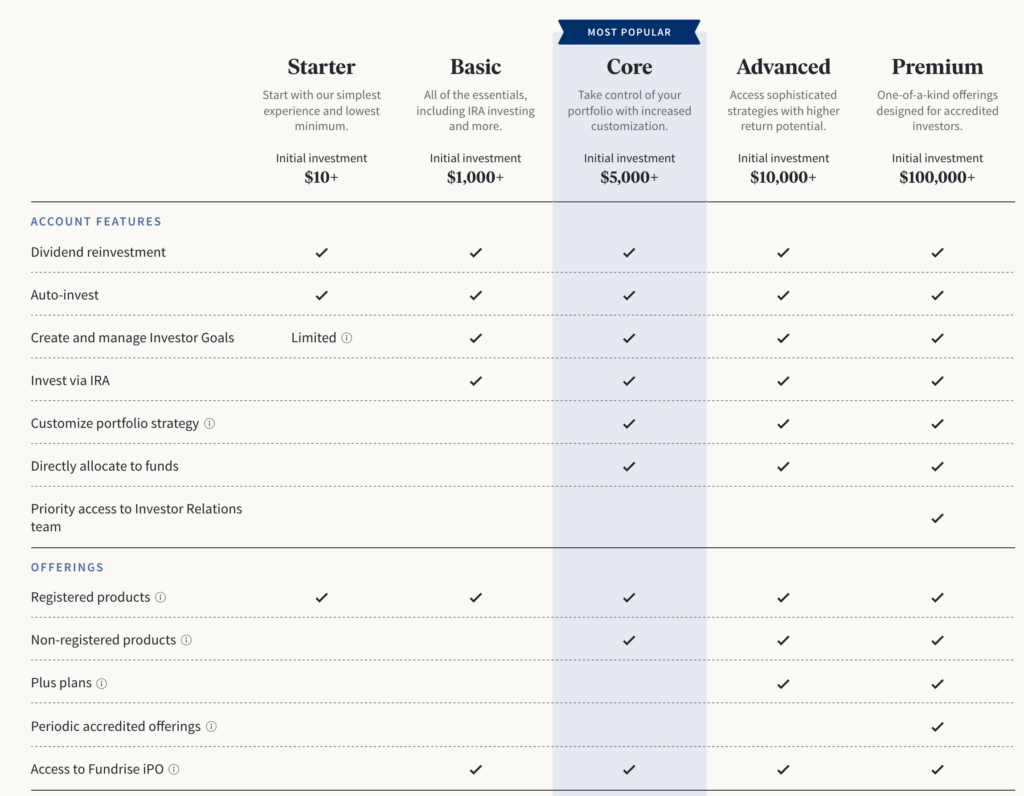

Fundrise makes it especially easy for investors to start small and grow. They offer plans that start with a minimum investment of $10, in addition to more sophisticated plans, including access to an investment relations team starting at a $100K investment minimum.

Source: Fundrise

Source: Fundrise

Major benefits of using Fundrise

I believe the major benefits of Fundrise have to do with ease of use, in addition to investment minimums that are attractive for the non-accredited investor of alternatives.

Fundrise track record

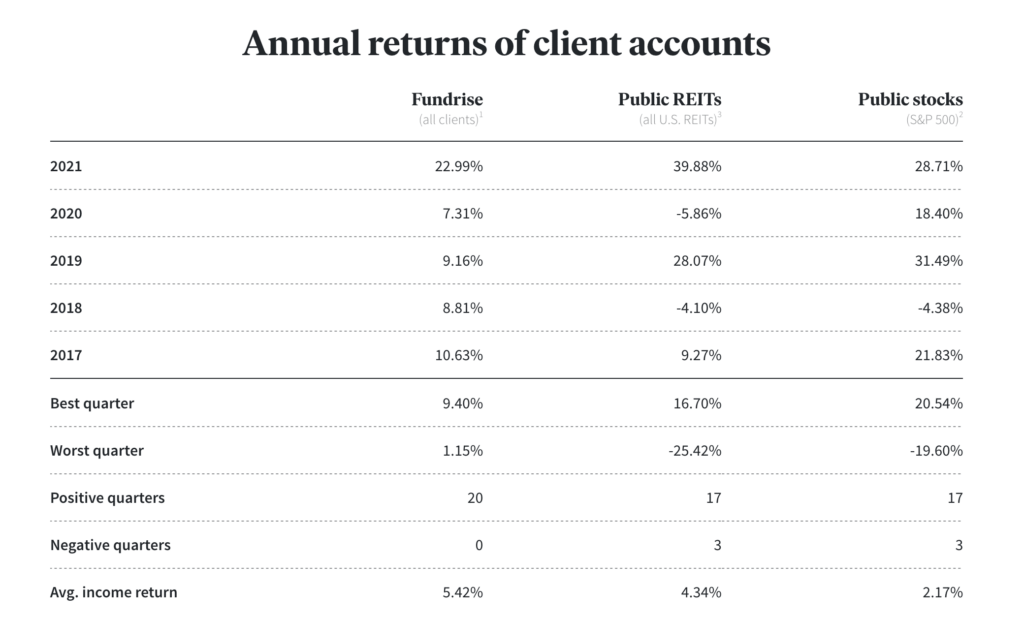

As an investor, we like transparency: it’s one of our core missions at AltExchange. Fundrise is transparent in how they report on their performance. Below is a snapshot of their performance.

Source: Fundrise

Source: Fundrise

Top Fundrise alternatives to consider for non-accredited investors

Yieldstreet prides themselves on providing access to institutional grade investments (previously only available to the ultra-wealthy) to both accredited investors and non-accredited investors. Yieldstreet’s alternative investment opportunities start at $1,000.

DiversyFund focuses predominantly on real estate as well. But unlike Fundrise, they’re focused on multi-family investing. What I personally like about multi-family investing is the scalability. Multi-family investments provide the ability to make slight changes to one building, with a meaningful impact on net operating income.

Groundfloor is another Fundrise alternative to consider if you’re non-accredited.

Groundfloor offers short-term, high-yield real estate debt investments. While we don’t provide tax advice, what you should consider between direct equity ownership through projects like Fundrise or Yieldstreet (in the case where you’re investing in equity, not debt) are the tax implications. Often, as I’ve seen in my portfolio, high-yield debt instruments like Groundfloor can be great for yield, but they often don’t have the depreciation benefits that real estate can have.

Top Fundrise alternatives for accredited investors

CrowdStreet is a real estate platform that’s available exclusively to accredited investors, exclusively in commercial real estate. The projects range from multi-family investments, office buildings, ground-up development, and much more.

Investments in Crowdstreet are far less liquid than what’s traditionally available to non-accredited investments. There is generally a liquidity discount that you receive on investments: The longer your money can be tied up, the more likely it generates a higher return.

Additionally, Crowdstreet has higher minimum investment amounts, starting at $25,000. I’m a personal investor in Crowdstreet, because I believe it offers a good selection of opportunities.

As its name suggests, AcreTrader offers an interesting investment opportunity in farm land. As an investor, you can earn your return based on the increase in land value as well as the annual rent that farmers pay to Acretrader, and thus the yield that you receive. Acretrader allows you to invest through your self-directed IRA, which adds some tax benefits to an already tax-efficient investment.

Why it matters

Overall, there are plenty of ways for both accredited and non-accredited investors to get started investing in real estate and other projects via online funding platforms such as FundRise.

The rise of alternative investments, including owning partial shares of real estate, offers investors a more diversified, balanced, and risk-averse portfolio. Not to mention, allows the everyday investor to start building their portfolio the same way the ultra-wealthy investors are building theirs.

As we always say, it’s important that you use an alternative investment platform like AltExchange to keep track of performance yourself, and be a more efficient investor as you’re increasingly allocating investment dollars across various platforms.